“Should I invest in an RRSP or a TFSA?”

This is a common question we are asked by clients. Some feel that RRSPs have gained a reputation of being worse for taxes in the longer term than a TFSA would be. Is this reputation justified?

The most common way to answer this question is to ask: “Will I be in a higher or lower tax bracket than I am now when I retire?” This question is met with the common answer “If you’re in a higher tax backet now than you will be in retirement – contribute to your RRSP. If not, contribute to your TFSA.”

While this is a good rule of thumb, there are other factors to consider.

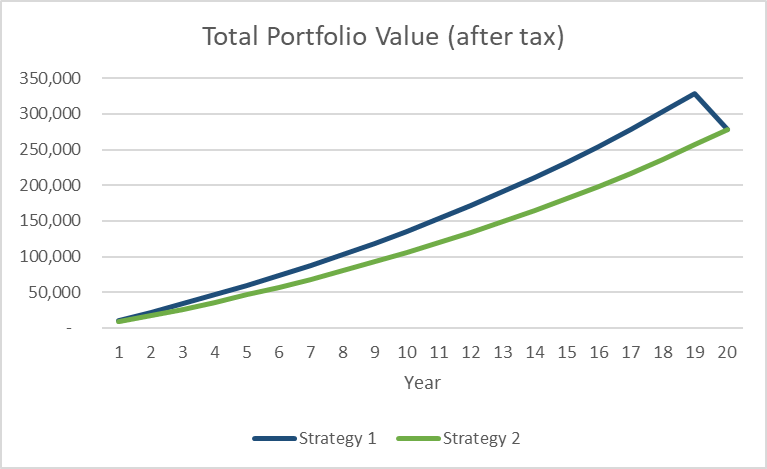

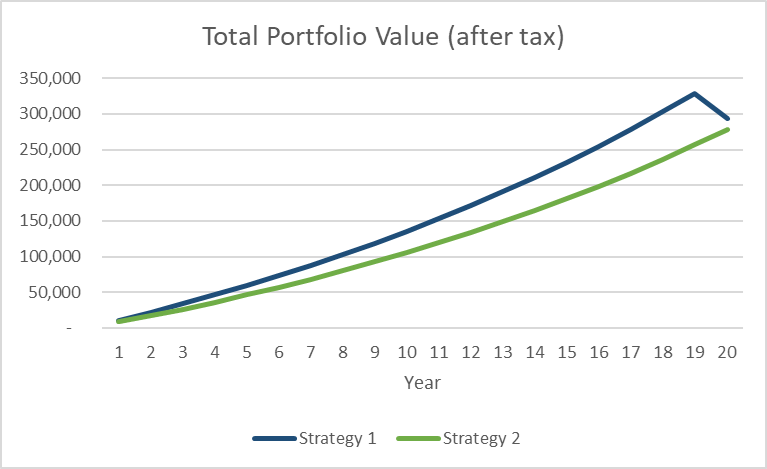

Let’s explore two scenarios. The first is where you expect to be in the same tax bracket in retirement and the second is where you expect to be in a lower tax bracket in retirement.

Scenario 1: Same Tax Bracket in Retirement

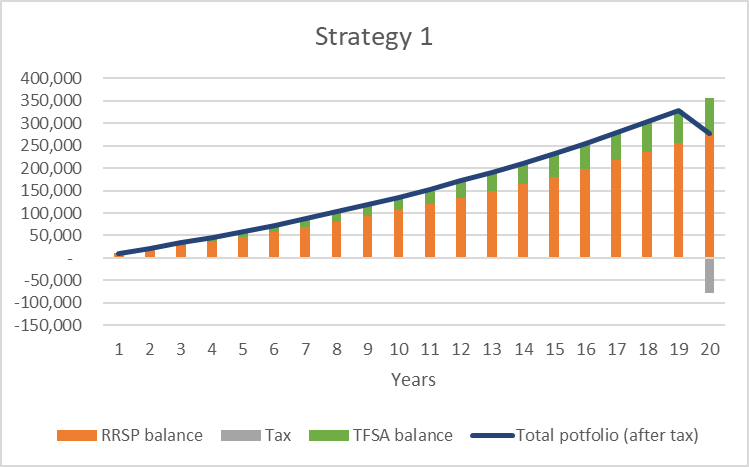

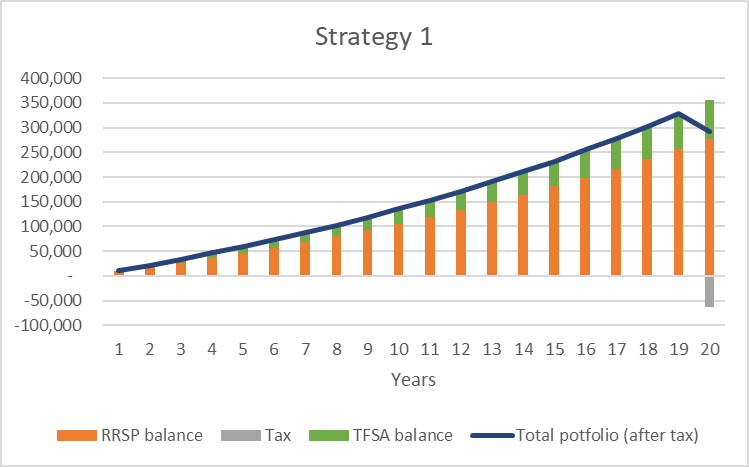

Strategy 1: Invest 10% of your income each year into your RRSP and invest the tax savings each year into your TFSA.

Strategy 2: Invest 10% of your income each year into your TFSA only.

For scenario 1, we will hold the following constant:

Current marginal tax rate: 28.2%

Marginal tax rate in retirement: 28.2%

Annual growth on invested assets: 5.0%

Contribution period: 20 years