Hey Vince,

Enjoy your college days. Heads up…on August 27th, 2022, watch your speed! If you don’t, two speeding tickets in one day…within an hour…seriously!

Anyway, since I have the opportunity to write to my younger self about things I have learned about finances, here are three things to keep in mind to be in good shape financially.

First: Make time to understand the basics of personal finance

Make time to learn the basics about budgeting, banking, investing (RRSPs, TFSAs, FHSA, RESP), real estate (owning our own home one day). Here are some great links to read with some good financial basics.

Budgeting

Banking, Loans, Mortgages

Taxes

Investing

How money can work for you instead of you working for your money

RRSP Basics

TFSA Basics

Second: Spend less than you earn

Seems logical but this is sometimes hard to do when you are just starting out. This discipline early in life will reap big benefits later in life. (IMPORTANT: In first-year university, don’t buy your bed on your credit card. You won’t pay that off for another 4 years. Find a way to pay with cash.)

If you are just starting out, here are some ideas:

- Set a minimum of 10% earnings aside into savings

- If you are living at your parents’ home and working – look to save 70%-80% of your employment income while mom/dad are still paying a lot of the bills

- This financial slingshot won’t last forever, so maximize its benefit

- For example: if you earn $4,000 net of tax per month

- 80% = $3,200/mo which equals $38,400 in a year

- If you earn 5% on this money for three years you would have $124,010. Not bad for three years

- Keep in mind, these easy saving days don’t always last once you move out, have kids, etc.

Third: Don’t fall prey to get rich schemes

If it seems too good to be true, it is. Yet how often we humans get suckered into the opportunity of “easy” money. Instead, make use of the power of compounding by investing in things that make a reasonable return and get us to the destination with minimal bumps along the way. When we first start out, we will work hard for our money, and it will sometimes seem like we aren’t getting anywhere. Trust me in this, if we invest in good quality investments early, when we get older the reverse will be true, our money will be working hard for us. I see this now, starting to look at the other side of life.

The power of compounding

Here is the power of compounding at work. Let’s say we started with a penny…yep 1 cent. And our money doubled in value every day. Here is what it looks like after 30 days.

| Day 1 |

$0.01 |

| Day 2 |

$0.02 |

| Day 3 |

$0.04 |

| Day 4 |

$0.08 |

| Day 5 |

$0.16 |

| Day 6 |

$0.32 |

| Day 7 |

$0.64 |

| Day 8 |

$1.28 |

| Day 9 |

$2.56 |

| Day 10 |

$5.12 |

| Day 11 |

$10.24 |

| Day 12 |

$20.48 |

| Day 13 |

$40.96 |

| Day 14 |

$81.92 |

| Day 15 |

$163.84 |

| Day 16 |

$327.68 |

| Day 17 |

$655.36 |

| Day 18 |

$1,310.72 |

| Day 19 |

$2,621.44 |

| Day 20 |

$5,242.88 |

| Day 21 |

$10,485.76 |

| Day 22 |

$20,971.52 |

| Day 23 |

$41,943.04 |

| Day 24 |

$83,886.08 |

| Day 25 |

$167,772.16 |

| Day 26 |

$335,544.32 |

| Day 27 |

$671,088.64 |

| Day 28 |

$1,342,177.28 |

| Day 29 |

$2,684,354.56 |

| Day 30 |

$5,368,709.12 |

Notice how long it takes to break $100…15 days. That is halfway to the end. But look at it move from there!! This is the power of compounding; time is your friend. What is one thing you have on your side that your parents don’t have…time. Let’s maximize it.

There are other things that I would love to add for my younger self, but I am only allowed three financial things.

Oh, one last thing, VERY IMPORTANT! You will meet a stunning beauty (inside and out) when you are 20. You won’t be able to miss her. Marrying her will be one of the best decisions you will ever make!

Enjoy!

Vince, your older self

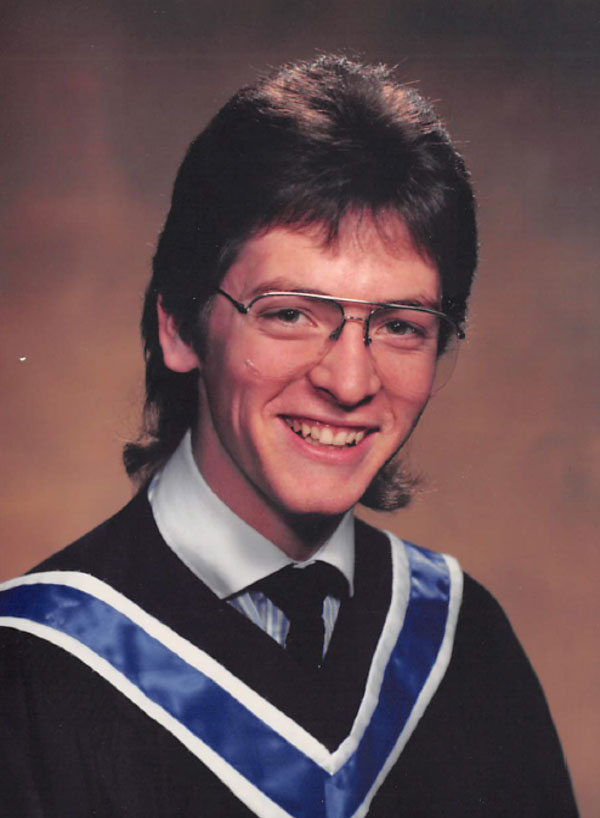

The first thing I would tell my 18-year-old self: get a haircut. Oh my, what was I thinking? When my boys turned 13, I reached out to men in our circle of friends and family and asked them what they would have said to their 13-year-old selves. It was fascinating to hear their responses. It had nothing to do with money; it was all about building character, the importance of who your friends are, the importance of faith, and how each of these areas of life shape who we become. For this blog, I will leave the more important life decisions for another day and focus on three financial things that I would tell my post-high-school self. So here we go, my letter to my 18-year-old self.

The first thing I would tell my 18-year-old self: get a haircut. Oh my, what was I thinking? When my boys turned 13, I reached out to men in our circle of friends and family and asked them what they would have said to their 13-year-old selves. It was fascinating to hear their responses. It had nothing to do with money; it was all about building character, the importance of who your friends are, the importance of faith, and how each of these areas of life shape who we become. For this blog, I will leave the more important life decisions for another day and focus on three financial things that I would tell my post-high-school self. So here we go, my letter to my 18-year-old self.