For almost 20 years (in the Lower Mainland especially) real estate has been a pretty sure thing. Many people we’ve talked to over the years have said that real estate is a guaranteed money maker. In most areas of BC this may have been true; ask the people of Detroit and they may think otherwise. Recently, we have seen a softening of the real estate market. So what seems to be driving this softer market?

1. Increase in Interest Rates – The Bank of Canada has increased interest rates over the last year and they are expected to continue this upward trend.

2. Restrictions in Lending Rules – The Federal Government introduced legislation on the lending rules for Canadian banks and credit unions. This reduced borrowing power in some instances by 18%. (Read more about Financial Stress Test: New Mortgages Rules here!)

3. Foreign Buyers Tax – There had been some speculation that foreign buyers were distorting the BC real estate market. As result, BC Government introduced a 15% tax on foreign buyers.

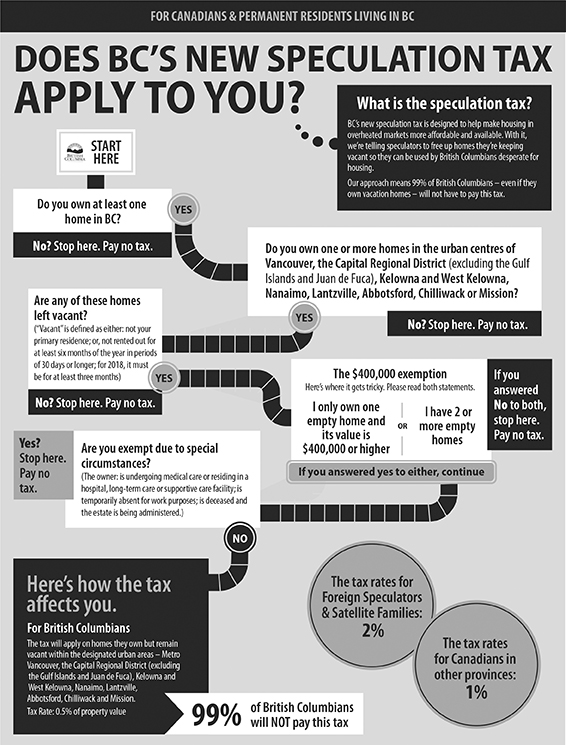

4. Speculation Tax – In strong real estate areas (such as the GVRD, Kelowna, West Kelowna, Victoria and the Fraser Valley) BC introduced a tax on empty properties or properties that are rented for less than 30 days at a time. This tax is 0.5% if you live in BC, 1% if you live in the rest of Canada and 2% if you are a foreign buyer.*

5. Rent Controls – The BC government recently made it more difficult for landlords to increase rent in BC.

The result: the market has softened in BC and in other parts of Canada as well. Depending on the area, prices have dropped more than 5%.

USEFUL LINKS:

- Check out My Realty Check and see real estate price changes in your area.

- *You can view the map of areas effected by the Speculation Tax by downloading the Tax Information Sheet from the Ministry of Finance: https://www2.gov.bc.ca/assets/gov/taxes/property-taxes/publications/is-2018-001-speculation-tax.pdf

If you have any questions on how these changes may affect your financial future, do not hesitate to contact us!

Singer Olfert Financial Group

Singer Olfert Financial Group