Over the last three months, the investment markets have finally gone down. When you receive your investment statement, be prepared to see a lower number than your previous statement.

Is this a surprise? Should we be afraid?

We have been talking about the stock market going down for some time. Regular market gains have been so commonplace over the last number of years that when there was a slight loss within a month it was met with surprise. Because we know that markets naturally correct at some point, we have continually emphasized the importance of having the proper asset allocation in client portfolios.

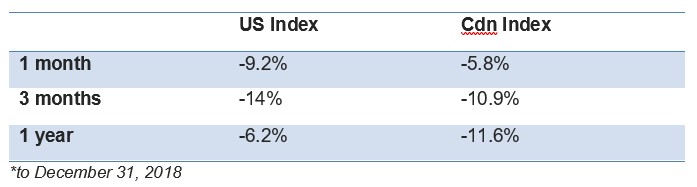

The US Index was down 9.2% in December and down 14% since October 1st. A 10% drop is considered an official market correction, whereas a bear market is a correction of 20% or more. See the chart below for more market numbers.

Does this mean that investments are bad and don’t work? No. Not at all. The market naturally goes through cycles to clean itself out of “froth” and “waste.” When markets are down and people are afraid, your investment teams take the opportunity to buy up mispriced stocks.

So what do you need to do?

1. Be aware.

It is important to know what you own and why you own it. Remember, your portfolio managers invest in dividend paying companies. In a down market, you are still generating cash flow and are using that cash flow to buy these companies at reduced prices.

2. Be calm and stay the course

Don’t make drastic changes when the market is down. Your portfolio managers will rebalance the portfolio to your asset allocation (the % of stocks versus bonds) automatically.

3. Don’t try and time the market.

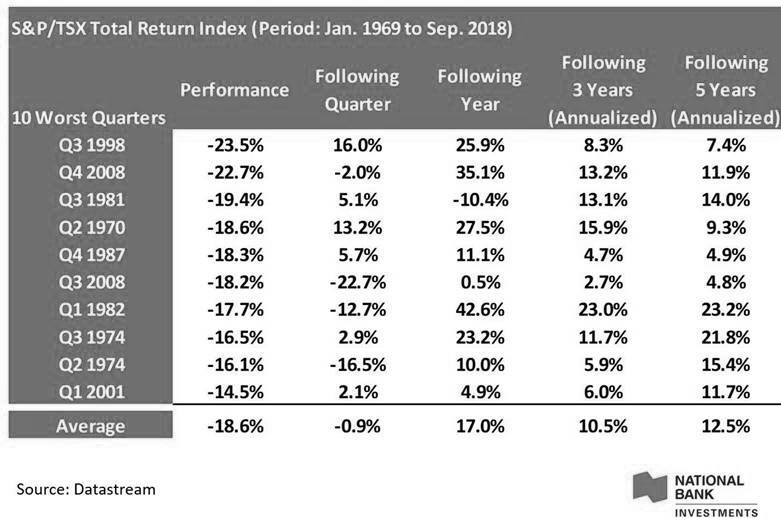

When the market is down, it can be a good time to allocate capital to investments. Is this the bottom? I have no clue. But it is definitely lower than it has been. Here is a chart from National Bank that shows Canadian market returns following negative quarters.

Please call us if you have questions or concerns, but be reassured that the portfolio managers are working diligently to manage risk and capitalize on opportunities.