I started my investment journey at age 24 with the first $10,000 I’d saved after paying off my student loans. I didn’t know anything about investing other than what the classic board game “Stock Ticker” had taught (buying low + selling high = good). I made an appointment with a representative from my bank to put my money to work.

Considering that I’m simply a number to my bank, it is logical that my meeting was short and why I felt like they didn’t care about me and my preferences or opinions about investing. What I did not understand was why the advisor didn’t take the time to educate me on investment risk in a meeting dedicated to set up investment accounts.

Fast-forward to now where providing sound financial advice, planning, and education is my mandate, and where conversations about values, goals, preferences, and risk take place before new clients complete their risk surveys.

In the case of Sally Sampleton

In my observation, the more perspective a potential investor has, the more growth-minded they often end up after completing their risk surveys. Take the case of Sally Sampleton, who wants to put her money to work but is uneasy about investing because she watched her parents make some poor investment choices growing up. She’s heard great things about the stable nature of GIC’s but after an educational conversation with her advisor, she was concerned about the effects that inflation could have on her retirement nest egg. Consequently, Sally wanted more information about investments with a long track-record of increased growth, dividend income, and stability. Her request for more information came about because a simple conversation led to her gaining greater perspective.

This is not to say that a prospective investor should feel like they need to take on more risk than they are comfortable with, nor is Sally Sampleton’s example to be considered financial advice – I am only putting forth an observation.

It’s all about perspective

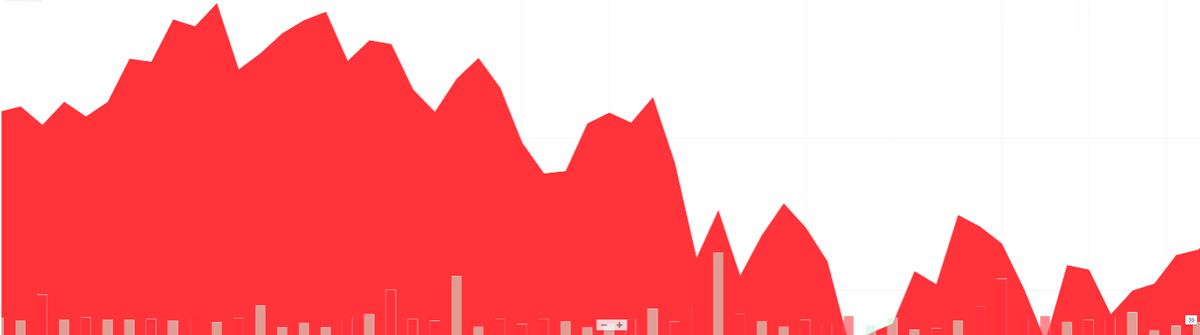

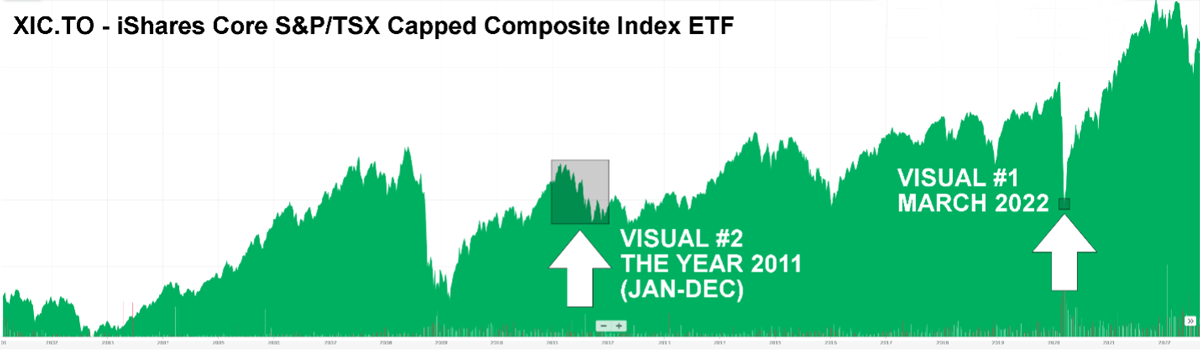

Let’s unpack the concept of investment perspective by using pictures and questions to help it hit home.